Credit Card Shopping !!!

Let's say you are spending 20000 on your credit card and paying the same on the last day of your interest free day to avoid interest.Does that mean bank has offered you interest free loan for 50 days?In a personal loans scenario,if you borrow 20000 with 11% interest for 50 days then you pay Rs=301.40 as interest for those 50 days.(i.e 20,000 * 11% * (50/365) = Rs. 301.40.) whereas in credit cards you are not paying single cent to your bank if you payback within your interest free days(50).I guess Citibank in India gives you 5% money back on your total amount spent on your credit card.Sounds fishy doesn't it? Let me explain,Say you are buying a camera worth of Rs 20000 from Sony world using your ICICI Visa Credit card.

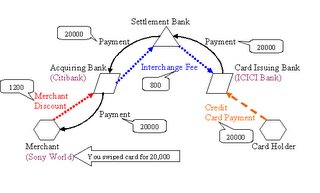

You present your ICICI Bank credit card, a VISA card. Sony World swipes your card on a machine provided by Citibank.Lets call Citibank as the acquirer bank by Sony World. Sony World swipe the card on that machine, requesting authorization. Citibank communicates with the card issuer, ICICI Bank through VISA Network to check if the card is valid and has the required credit limit. ICICI Bank reviews and approves / declines which is communicated back to Sony World. You sign a receipt called Sales Draft given by Citibank. This is the obligation on your part to pay the money to ICICI Bank.Data on this receipt can be captured electronically and transmitted.

At the end of day or at the end of some period Sony World submits the receipt you signed to Citibank who pays Sony World the money. Sony World pays Citibank a fee called Merchant Discount .Let us say this is 6% of the sale value = 6% * 20,000 = Rs. 1200. Citibank sends the receipt electronically to a Visa data center which in turn sends it to ICICI Bank. ICICI Bank transfers the money to a settlement bank which in turn transfers the funds to Citibank. Citibank pays ICICI Bank an Interchange Fee of 4% of the sale value = 4% * 20,000 = Rs. 800. And 20 to 50 days later ICICI Bank gets the money from you and you don't have to pay the interest!!

So Sony World pays more than the interest that you should have paid for the loan that you take. You, as a cardholder have the following benefits,

1. Convenience of not having to carry cash.

2. Credit availability free of interest.

However what benefits does Sony World get for paying so much money? Isn't it more profitable for them to take cash? They can save as much as Rs.1200.Yes, and that's the secrete behind some other shops offering discount if you pay cash(Pay Less, Pay Cash) remember now.

On the other hand when you don't count the money that you are spending, you tend to buy more! This is called impulse purchase.Credit cards encourage impulse purchase. If you did not have access to credit card, you would not have bought the camera this month or may be not any time soon either. By accepting cards, the merchant is actually extending you credit at the risk of the card issuer. He pays money to the banks to carry that risk.Banks(ICICI,CITIBANK) uses this money to pay back to you when they announce 5% cash back. They insist that the Sales draft that you sign at the retailer should also be from the same(ICICI,CITI) Bank. This means they are saving on the Interchange Fee and also pay me a part of the Merchant Discount that they get.

If you have noticed, Banks gives you the cash back in the next credit card statement. They keep the cash back money for a maximum of 60 days before passing on a part to you. This accrues them interest too.Say if ICICI Bank earns an interest of 6% per annum for the cash they carry, they get Rs.1000 * 6% * (60/365) = Rs. 10 .That is not huge, but money nevertheless. when you consider that almost everyone in this city shops with a credit card these days, it is a big sum and same thing goes with Petrol cards as well. After home loans,credit cards is the main resource for banks revenue.Following chart explains the the whole process .

In my opinion,if you wanna save money then link your credit card with your savings account and always try to pay your bills by using your savings.

10 comments:

Adeengappaa! evloo matteraaa ethulaa? i still afraid of getting a credit card. of course i've no need of it at this stage. may be useful when i getting married! (i pray that my gal should not have a shopping mania)

good info. i think i need to read one more time to get a clear pic..

btw,don't worry, i won't charge u fee.. chinnadha, Australiaya oru velai vaangi kudunga! (kesari kindra velainaa kooda ok!)

namma ooru maakaa enga poongallum irukaangayaaa... Nice to hear that you are from tirupur.

I got this credit card process flow as an forward some time back.. Its good to know abt it.. evanuku laabaam... namma kaasu enga enga poguthu yellam nalla puriyudhu..

@ambi: ungalaku kesari kindra velai koduthaa kesariku yaaru guarantee kodupaaa...

@Ambi:Ponnu,Figure,Kadalai,Kalyanam,Kesari ithu mattum thaan think pauvengala ambi;)j/k.Aus la velai thane no worries erpadu panita pochu.Nenga wipro la thane work panarenga?

@Neighbour:Thanks for u r visits and comments.adikadi vanga.

thats interesting...

Gops, naan oru credit card vangi adhai adhisayama oru edathula thechu avanga thappa amount pottu 6 masam suthina suthuku, credit card pathi enga kettalum I run in the opposite direction!

@Sendhil:hmm

@Usha:Ungaloda idea(running opposite direction) innum super.

kandeepa vanditae irupoom.. kavalai padaatennnga...

eh appa...ivlo matter irukka..im really scared of credit card spending....Im only so generous with debit cards ...appo credit cards pathi kekkave venam...customer carela...assaultaa

very sweet and smilingaa convince pannapo romba yosikkala..ithulla ivlo matter irukka..telivaa purinjiduchu...inime cutomer carelairunthu phone pannatum..ill say....Don talk too much...I know everything....

@Shuba:Visa la kuda ipoo debit card varuthu,vangikonga.:)

Cool blog, interesting information... Keep it UP Zoloft bad side effects how long to get prozac out of system Aluminumpatioawnings cheap+international+prepaid+calling+card jobs Adderall cause does loss weight Venlafaxine package insert What is imitrex oral warming celebrex Tips on mortgage refinancing

Post a Comment